“We feel like it’s a bait and switch.”

That’s Michael Cao, CEO of bitcoin mining firm ZoomHash, one of a number of bitcoin miners currently involved in a months-long dispute over power costs with a public utility provider in Chelan County, Washington.

Cao isn’t alone. Other bitcoin miners in the region say they were drawn by promises of cheap power, a circumstance that’s now subject to possible change.

Washington state is home to some of the cheapest power sources in the US, a circumstance that, in recent years, has drawn more than a few entrepreneurs hoping to establish profitable bitcoin mines. Given that bitcoin mines thrive on cheap electricity – some have compared the business model to a power arbitrage – it’s natural that some would gravitate to a region that boasts significant hydroelectric power capacity.

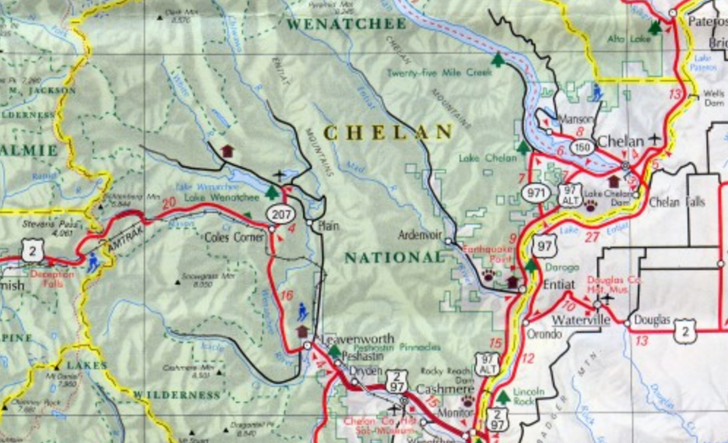

Counties like Chelan and neighboring Douglas and Grant Counties have attracted bitcoin miners as a result, though those areas are not currently considering any form of rate increase.

Yet the seemingly fertile ground in Chelan could change in the months ahead, as the public utility district (PUD) is currently weighing a rate increase that local bitcoin miners say could force them to cut expansion plans, layoff employees or shut their doors entirely.

Chelan County, which according to US Census data has a population of roughly 75,000 people, boasts three hydroelectric plants along the Columbia River.

A moratorium on high-density load customers, which includes bitcoin mining firms, has been in place since December 2014 and is set to expire in October , by which time the PUD intends to have a rate increase plan firmly in place.

The utility is currently weighing a plan to raise rates for customers that use more than 250 kilowatts per square foot, a move that would include the power-hungry bitcoin mines in Chelan. This would mean a power cost of roughly five cents per kilowatt hours.

The past several months have seen a raft of public comment submissions and community hearings on the matter, with a decision looming on whether customers has draw significant amounts of power - including bitcoin miners – will have to pay more or seek alternatives.

Cao told CoinDesk that his firm’s expansion plans would be curtailed if the power costs were to jump – and that it’s likely staff cuts and a possible relocation to more miner-friendly areas would soon follow.

He told CoinDesk:

“We invested millions of dollars in the community, and all of a sudden, they’re thinking of doubling our rates.”

Rivery valley mining

In interviews, bitcoin miners in the area say that it was the big boost in bitcoin’s popularity back in 2013 that first sparked an effective gold rush to the region. This resulted in a wave of applications for power that, according to some, may have set the stage for the friction between miners and the public utility today.

Stories of angry phone calls and in-person visits that neared the point of harassment suggest that the the early days of bitcoin mining in Chelan County may have overwhelmed a utility previously unfamiliar with the technology.

John Stoll, the PUD’s managing director of customer utilities, told CoinDesk that the volume of high-power requests that the utility received were out of the norm.

This, he recalled, prompted a process that he suggested is still subject to further debate and input from both the bitcoin mining sector in the region as well as the broader community.

To date, said Stoll, the PUD has held more than 20 meetings with the public as well as the PUD board to discuss the matter. The utility is set to hold another public meeting on 21st March, at which the utility says more ideas will be put on the table for discussion.

‘We’d be out of business’

HashThePlanet co-founder and COO Dan Conover says that, initially, he and his team were infuriated by what they perceived to be an effort that specifically targeted bitcoin miners.

However, he said that indications that the PUD was softening its early stance has given him hope, but that any situation in which the utility costs are doubled for miners would put his operation in a position in which it would need to either move or fold.

“Well, we’d be out of business,” he said when asked what would happen if the power rates were raised. “And that’s all there is to it. We’re at about a 40% margin, and that’s mostly based on power. I mean, I have plans to hire more people.”

Still, according to Conover, the heart of the issue lies in what the exact cost of these bitcoin mines is to the PUD – math that he says, to date, hasn’t been provided.

“The last meeting we had with them was a breath of fresh air. They said we’re gonna pump the breaks, we’re going to have another meeting in October,” he said. “But again, going back to the numbers, the one thing I tried to push on them is that – what’s the cost of customer service?”

Concerns heard, says PUD

Stoll disagreed with the idea that the PUD is directly targeting bitcoin miners, framing the utility’s desire to raise rates as part of a broader goal to keep power costs low across the county.

Still, he said the PUD is sympathetic to concerns from bitcoin miners that a rate increase would threaten the viability of their businesses.

“The board has been listening to those customers and they’ve heard that message loud and clear. That’s why they’re trying to learn more about this technology. They’ve been vocal that this has been part of their concern, and the board is listening to that,” he said.

“Nobody wants to see anyone lose a job or lose economic vitality in the community,” he added.

Moves seen as prohibitive

At least one bitcoin miner has stayed out of Chelan County entirely as a result of the PUD’s moves. Dave Carlson, founder of MegaBigPower, told CoinDesk that the utility “threw bitcoin miners under the bus” in its plan to raise rates.

“Their actions against our industry began in early 2015 and were fairly obvious. Enough so that I put the brakes on a $1m project in early 2015 and have had the electrical distribution equipment removed and transported to the county I do my primary business in,” he told CoinDesk, adding:

“They cost me about $200,000 with this decision, but I fear they have put other miners out of business.”

MegaBigPower is one of the oldest industrial bitcoin mining operations in the US, rising to prominence on claims by Carlson that his Washington-based facilities were producing $8m a month at the height of the bitcoin boom in 2013.

“If their goal was to run Bitcoin mining out of Wenatchee, well they certainly achieved it,” Carlson concluded.

Cao told CoinDesk that had he known this rate increase would be a possibility, his firm would not have set up in Chelan in the first place.

“If we knew there was the threat of a rate increase, we wouldn’t have made the millions [of dollars] in investments, hired and trained our employees just to lay them off in less than a year,” he said.

Answers to come

The meeting next week, Stoll said, was a significant one for the process, one that would likely set the stage for continued deliberations. The goal, he said, is to have a plan in place by mid-summer, ahead of the moratorium expiration this fall, which he said the PUD wants to lift.

He said it was “unfortunate” that bitcoin miners feel like they’re being unjustly targeted during the process, emphasizing that the utility feels like it is taking a neutral stance and listening to all stakeholders.

“We’re really neutral and we want to know what the opportunities are as well. We just want to learn more about this,” he remarked, going on to say:

“I think we can come up with a win-win situation. We encourage that group to get out, to get out there with their message.”

Conover, like the other miners in the region, said that he’s waiting to see what ultimately comes of this process – but reiterated that he wants to see facts driving the process, not possibilities.

“I want to see hard data,” said Conover. “I don’t want to see hypothetical data.”

For his part, Cao struck an optimistic tone about the process, indicating his hopes that the PUD won’t move to push bitcoin miners with higher prices and concluding:

“October is a long time from now. Hopefully they’ll look at the costs and the economic benefits.”

Washington image via Shutterstock